Blockchain & Web3 for Startups: Why 2025 Is the Year of Trust and Transformation

Innovation has always been the heartbeat of startups. In 2025, one technology is reshaping that rhythm: blockchain for startups. For UK founders navigating volatile markets, rising customer expectations, and the need for trust at scale, blockchain is no longer a futuristic concept. It is a practical tool for reimagining finance, identity, and loyalty in ways that were unthinkable just a decade ago.

The story mirrors other industries. Just as the vaping market shifted from disposables to refillable, sustainable devices, business finance is moving from centralised institutions towards decentralised trust systems. The direction is clear: sustainability, transparency, and long-term value are driving adoption. For startups, this moment represents both urgency and opportunity.

From Experiment to Essential: Blockchain’s Startup Journey

When blockchain first emerged with Bitcoin in 2009, it was seen as disruptive but niche. Over the past decade, however, it has matured into a multi-faceted technology spanning payments, supply chains, healthcare, and governance. According to the World Economic Forum, over 10% of global GDP is expected to be stored on blockchain technology by 2027, underscoring its growing role in mainstream economies (WEF, 2023).

For startups, the key shift is accessibility. What was once confined to tech pioneers is now available through incubators, accelerators, and expert consultancies. Today, it’s entirely possible for early-stage businesses to sign up for new blockchain startups programs, gaining access to infrastructure that previously required enterprise budgets.

Why UK Startups Cannot Ignore Blockchain in 2025

The UK has positioned itself as a hub for fintech and Web3 innovation. Government funding, venture capital interest, and rising consumer demand for transparent business models make this the right time to act. Deloitte’s recent analysis highlights that blockchain is already helping reduce fraud, streamline compliance, and open new revenue opportunities for small businesses. Startups that ignore these shifts risk falling behind competitors who integrate blockchain from the outset.

The value of blockchain for startup founders lies not only in technology but also in perception. Customers increasingly demand that businesses are ethical, secure, and efficient. Blockchain delivers verifiable trust, ensuring records cannot be tampered with. This isn’t just useful for finance—it applies equally to customer loyalty programs, supply chain transparency, and even digital contracts.

Unlocking Ideas and Business Models

For entrepreneurs, blockchain ideas for startup projects are multiplying. Embedded finance, decentralised identity verification, and tokenised loyalty schemes all provide practical use cases. These models are attractive not only because they improve efficiency but because they align with customer values of transparency and fairness. The startups that capitalise on this alignment will be those that survive and thrive in competitive markets.

At TheCodeV, we have seen how UK startups across sectors—from retail to property tech—are leveraging blockchain to build trust with investors and customers alike. Our expert services are designed to help founders transform these opportunities into scalable, future-ready solutions.

A Decisive Moment for Startup Growth

The lesson from 2025 is simple: blockchain is no longer optional. It is a foundation for finance, trust, and new business models. For startups eager to scale and differentiate, adopting blockchain early can be the difference between becoming a market leader or remaining invisible.

By moving beyond traditional systems and embracing Web3, UK startups have the chance to create lasting value—backed by the transparency, security, and resilience that only blockchain can provide.

Blockchain in Embedded Finance & Accounting for Startups

The financial foundation of any business rests on trust, accuracy, and efficiency. For emerging companies, these elements are often the hardest to secure. This is where blockchain for startups is creating a dramatic shift. From transparent accounting to embedded payments and new avenues for raising funds, blockchain ensures that finance is no longer a barrier to growth but a catalyst for innovation.

Transparent Accounting with Blockchain

Startups have traditionally relied on external auditors and complex bookkeeping systems to maintain compliance. But blockchain introduces a tamper-proof ledger that records every transaction with full transparency. For founders, this means fewer disputes, easier auditing, and stronger investor confidence.

Global firms are already leading the way. Deloitte has piloted blockchain-based accounting models that reduce errors and accelerate reporting cycles. PwC has also invested heavily in blockchain auditing, helping startups establish compliance-ready systems that scale as they grow. For any accounting firm for blockchain startups, these tools are transforming how financial records are verified and trusted.

A transparent ledger not only simplifies compliance but also positions startups favourably for funding. Investors increasingly demand proof of financial integrity, and blockchain provides that assurance in real time.

Embedded Payments and Financial Inclusion

One of the most immediate benefits of blockchain is in payments. Traditional banking systems can delay cash flow with slow settlements and high transaction costs. For startups operating in fast-moving markets, this can stall growth. Blockchain solves this by enabling blockchain payment solutions for startups—instant, secure transfers with significantly lower costs.

Startups in e-commerce, fintech, and digital services are embedding blockchain payments into their platforms to serve customers seamlessly. These systems also expand financial inclusion, giving access to underbanked markets where traditional financial infrastructure is weak. For UK startups with global ambitions, embedded blockchain payments reduce friction in cross-border trade.

The UK’s Financial Conduct Authority (FCA) has highlighted the role of digital assets in improving competition and transparency in payments (FCA, 2023). This aligns perfectly with the needs of ambitious UK startups.

Raising Funds with Blockchain

Fundraising remains one of the toughest hurdles for new businesses. Blockchain is redefining this process through tokenisation, decentralised finance (DeFi), and transparent equity records. Instead of relying solely on banks or angel investors, startups can access decentralised platforms to secure capital.

The opportunity to raise seed money for startups blockchain has opened entirely new funding models. Crowdfunding through tokenised assets allows startups to attract global investors while providing them with verifiable ownership stakes. For UK founders, UK funding for blockchain startups is also expanding, with government-backed grants and private venture capital increasingly prioritising blockchain-enabled ventures.

Effective fundraising is not just about raising capital—it’s about proving accountability. Blockchain ensures that funds raised are traceable, providing assurance to investors that their contributions are managed responsibly.

Compliance Made Simpler

Regulatory compliance is often seen as a burden for startups, but blockchain helps automate and streamline this process. Smart contracts can enforce rules automatically, reducing the need for costly legal oversight. For example, payments can be released only when predefined compliance conditions are met.

This automation aligns with the guidance of financial authorities. PwC’s recent reports stress the need for blockchain-enabled systems to future-proof compliance for small and medium-sized enterprises. Similarly, Deloitte argues that blockchain accounting will play a central role in meeting evolving tax and audit requirements in the UK.

How TheCodeV Supports Startup Finance Transformation

At TheCodeV, we understand that finance is the lifeline of any startup. Our team specialises in embedding blockchain solutions into payment systems, accounting structures, and fundraising strategies. We provide tailored pricing plans that align with the unique needs of early-stage businesses, ensuring startups don’t just survive but thrive in an increasingly decentralised financial landscape.

Blockchain for Identity, Trust & Security

In today’s digital-first world, identity is no longer a simple matter of documents and signatures. For startups, proving who you are and ensuring customers can trust you is central to building credibility. This is where blockchain for identity, trust, and security becomes transformative. By leveraging decentralised systems, UK startups can simplify KYC (Know Your Customer) processes, strengthen onboarding, and deliver loyalty programmes that are both secure and transparent.

Government-Level Identity Management

Identity verification has traditionally relied on paper documents, centralised databases, and long delays. But blockchain changes this model entirely. Instead of storing data in silos vulnerable to breaches, blockchain distributes identity records across a secure, immutable ledger.

It is no surprise that Deloitte partners with startup for gov’t-level blockchain identity management, helping nations and businesses adopt verifiable digital ID solutions. In the UK, government-backed pilots are already testing blockchain to streamline public services and reduce fraud in identity verification systems (Gov.uk, 2023). For startups, the lessons are clear: identity built on blockchain is faster, safer, and far more scalable.

KYC and Onboarding Simplified

Startups in fintech, e-commerce, and professional services face strict compliance demands when onboarding new customers. Blockchain-based KYC eliminates repetitive checks by allowing a user’s verified credentials to be reused across multiple services. This drastically reduces friction for customers while cutting compliance costs for businesses.

An expert blockchain consultancy for startups can integrate decentralised KYC solutions that not only meet FCA compliance but also improve customer experience. By embedding blockchain identity into onboarding flows, startups build trust from the first interaction—crucial for attracting investors, customers, and partners.

Security Benefits for Startups

Cybersecurity breaches are among the most common risks facing new businesses. Centralised databases are attractive targets for hackers, and even a single incident can permanently damage brand reputation. Blockchain provides a solution by eliminating central points of failure. Every transaction, record, and identity is validated across multiple nodes, making tampering nearly impossible.

This level of protection is particularly valuable for fintechs and retail startups handling sensitive payment data. Insurance providers are beginning to recognise this advantage, with insurance for blockchain startups becoming more accessible due to reduced fraud risks. A startup that demonstrates secure, verifiable transactions will often find it easier to negotiate better insurance terms.

Loyalty Programmes Reinvented

Trust isn’t limited to compliance—it extends to how businesses reward and retain customers. Blockchain is enabling startups to reinvent loyalty programmes by issuing tokenised rewards that are transparent, transferable, and fraud-proof. Customers can trust that their points or tokens hold value, while businesses benefit from deeper engagement.

For retail startups, blockchain-powered loyalty schemes create stronger customer relationships by offering tangible, verifiable rewards. This aligns with broader consumer demand for fairness and transparency in how brands interact with their communities.

How TheCodeV Helps Build Trust with Blockchain

At TheCodeV, we help startups turn blockchain’s promise of security into practical business outcomes. Whether it’s digital identity systems, onboarding flows, or customer loyalty solutions, our experts design trust-driven architectures that meet the demands of UK regulators and international markets. Startups looking to take the next step can easily contact us for tailored consultancy and deployment strategies

Blockchain Databases & Web3 Infrastructure for Startups

For modern startups, data is the backbone of every decision. From customer behaviour to financial records, the ability to store, secure, and analyse information often defines whether a business can scale successfully. In 2025, the limitations of traditional databases are becoming increasingly clear. This is why blockchain for startups is gaining momentum, with decentralised databases offering transparency, resilience, and scalability that conventional SaaS systems simply cannot match.

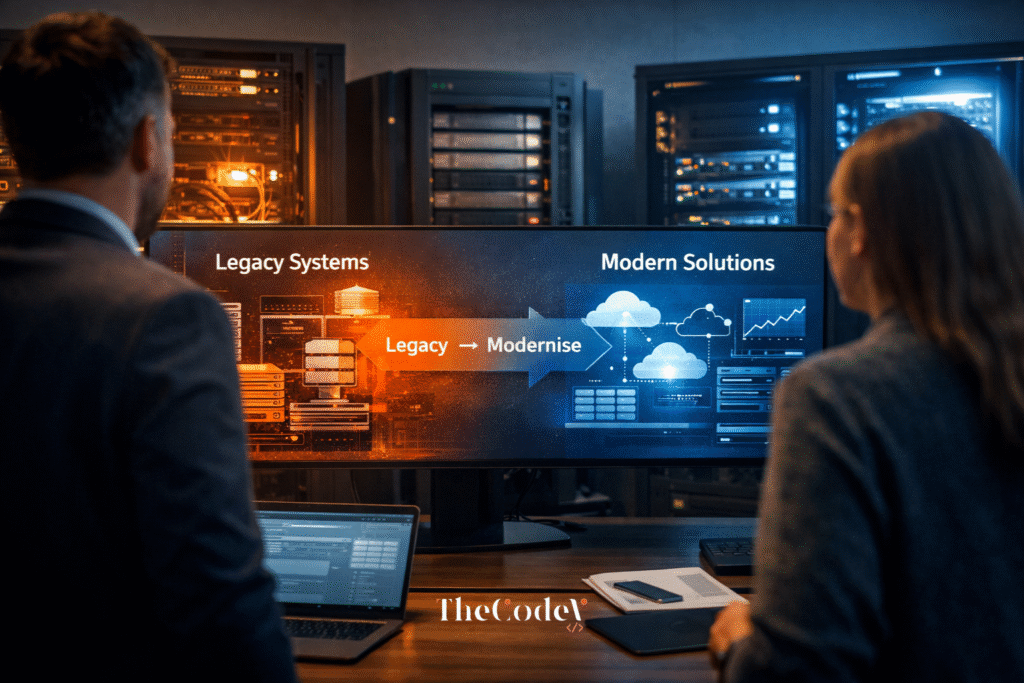

The Shift from SaaS to Decentralised Databases

Traditional SaaS databases, while convenient, rely on centralised servers. This creates a single point of failure—if the database is compromised, the entire system is at risk. Downtime, data breaches, and vendor lock-in are common issues that can cripple startups at critical growth stages.

In contrast, blockchain databases for startups distribute data across multiple nodes. Each transaction is verified and immutable, eliminating the risk of tampering. This distributed structure not only enhances security but also ensures that systems remain operational even if individual nodes fail. Startups gain resilience from day one—without the need for expensive infrastructure investments.

IBM has consistently highlighted blockchain’s role in providing tamper-proof, distributed ledgers, reinforcing why enterprises and startups alike are turning to decentralised systems (IBM, 2023). Similarly, MIT Tech Review has emphasised blockchain’s scalability in supporting large-scale, data-driven innovation.

Scaling with Web3 Infrastructure

Beyond storage, decentralised databases enable startups to build fully fledged Web3 ecosystems. With smart contracts, startups can automate workflows and enforce agreements without intermediaries. This makes blockchain development for startups more than just a technical exercise—it becomes a strategic advantage.

Venture capital interest reflects this trend. In 2024 alone, billions of pounds in global funding were allocated to Web3 ventures. Venture capital for startups blockchain projects is accelerating because investors recognise the long-term efficiencies that decentralised infrastructure delivers. The UK, with its thriving fintech and AI scene, is positioning itself as a hotspot for these investments.

For startups, the combination of decentralised databases and Web3 infrastructure means building platforms that are secure, scalable, and inherently future-proof. Whether it’s a retail platform, a fintech product, or a SaaS service, blockchain creates trust in the core of the business model.

Incubators and Technical Consultancy

Adopting blockchain infrastructure can be daunting for early-stage founders. This is where effective project incubators for blockchain startups and consultancies step in. Incubators provide mentorship, funding, and ready-to-use blockchain environments, while consultancies bring technical expertise to ensure solutions are not only deployed but optimised.

At this intersection, EmporionSoft stands as a key example. As a consultancy focused on scaling businesses through blockchain and AI-driven solutions, EmporionSoft helps startups transition from prototype to production, building robust systems that attract both customers and investors. Their work exemplifies how technical scaling, when handled correctly, becomes a competitive advantage.

How TheCodeV Supports Web3 Startups

At TheCodeV, we’ve supported startups in integrating blockchain into their business models, ensuring systems are secure, scalable, and investor-ready. Our approach combines technical depth with a keen understanding of market dynamics. Founders exploring About Us can see how our global expertise translates into UK startup success stories.

Blockchain databases are not just a technology—they are the infrastructure of tomorrow. For startups, embracing this shift early is a decisive step towards building businesses that last in an increasingly data-driven, trust-focused world.

Blockchain for Marketing, Loyalty & Community Building

Marketing has always been about trust and connection, but in 2025 the rules are changing. Startups no longer compete solely on product or price—they compete on transparency, engagement, and authenticity. This is where blockchain for startups reshapes the way businesses approach customer relationships. By enabling tokenised loyalty rewards, transparent influencer payments, and Web3 marketing strategies, blockchain offers startups powerful new ways to build and scale communities.

Reinventing Loyalty with Tokens and NFTs

Customer loyalty programmes have historically suffered from inefficiency and lack of trust. Points often go unused, systems are opaque, and customers question the real value of their rewards. Blockchain introduces a new model: tokenised rewards.

Startups can issue customer loyalty tokens stored securely on blockchain networks. These tokens are transferable, verifiable, and resistant to fraud. For example, a retail startup could offer NFTs as rewards, allowing customers to redeem them for discounts, exclusive access, or digital collectibles. This creates not only brand loyalty but also community ownership—customers feel genuinely invested in the startup’s success.

Gartner has reported that tokenisation and blockchain-enabled loyalty solutions are expected to drive higher engagement rates compared to traditional programmes (Gartner, 2024). For startups, this makes blockchain a cost-effective and future-proof strategy for retention.

Transparent Influencer and Partner Payments

Influencer and affiliate marketing are vital channels for startups, but trust in this space is often weak. Delayed or inaccurate payments undermine relationships and erode credibility. Blockchain solves this with transparent, automated payments recorded on immutable ledgers.

Through smart contracts, startups can release payments instantly when predefined conditions are met—such as views, clicks, or conversions. This makes partnerships far smoother and eliminates disputes. A blockchain marketing agency for custodial startups can integrate these solutions, ensuring compliance while building stronger influencer networks.

By making every transaction visible and verifiable, startups improve trust with partners and increase the likelihood of long-term collaborations.

Web3 Marketing and Content Creation

Marketing in Web3 extends beyond traditional advertising. It includes decentralised campaigns, community-driven engagement, and tokenised incentives for participation. For founders exploring blockchain content creation for crypto startups, this means shifting from one-way brand messaging to collaborative ecosystems where customers actively co-create value.

Post-ICO companies have already experimented with this model, using decentralised platforms to engage investors and users. Learning from these examples, early-stage founders can apply post ICO marketing tips for blockchain startups—such as community-driven reward pools and token airdrops—to generate buzz and foster engagement.

By embedding blockchain into content creation and engagement strategies, startups align themselves with an audience that increasingly values authenticity and transparency.

Strengthening Community Trust

The ultimate benefit of blockchain-enabled marketing is community trust. Customers no longer have to “take the company’s word for it”—they can verify reward issuance, track influencer partnerships, and see marketing campaigns unfold transparently on the blockchain.

This aligns with broader consumer expectations. HubSpot has highlighted that authenticity is now one of the top three factors influencing purchase decisions (HubSpot, 2024). Startups that integrate blockchain into marketing build not only loyal communities but also resilient brands capable of scaling globally.

TheCodeV’s Expertise in Web3 Marketing

At TheCodeV, we help startups navigate this new era of loyalty and engagement. From influencer strategies powered by smart contracts to tokenised loyalty schemes, our team ensures businesses stay ahead of market expectations. For retail and e-commerce founders, our tailored E-commerce SEO services complement Web3 strategies, driving both traffic and trust.

By combining blockchain with innovative marketing, startups gain the tools to not just attract customers—but to turn them into long-term brand advocates.

Blockchain for Global Expansion & Business Models

Scaling across borders has always been one of the toughest challenges for new businesses. Payments are delayed, compliance requirements differ by region, and traditional systems often exclude smaller players from operating globally. In 2025, however, blockchain for startups is proving to be the equaliser—enabling cross-border transfers, streamlined compliance, and business models designed for global growth.

Cross-Border Transfers with Blockchain

International transfers through banks are notoriously expensive and slow. Fees can consume a significant percentage of small transactions, and settlement delays disrupt cash flow. For an ambitious blockchain startup for transfer, these problems vanish. Blockchain enables near-instant, low-cost cross-border transactions without relying on intermediaries.

Startups in the UK and Europe are already taking advantage of blockchain to expand into new markets. For example, fintech companies leveraging stablecoins and decentralised ledgers have reduced transaction costs for customers by up to 70% (TechCrunch, 2024). For early-stage founders, this means more flexibility, faster scaling, and the ability to serve global clients from day one.

Smart Contracts for Global Operations

Expanding globally is not only about moving money—it’s also about managing agreements. Traditional legal contracts require manual enforcement and can be prohibitively expensive across jurisdictions. Blockchain smart contracts solve this by executing agreements automatically when conditions are met.

This shift is particularly relevant in e-commerce, SaaS, and service-based startups. A blockchain startup for personal assistant service, for instance, could use smart contracts to automate billing, ensuring both customers and service providers are protected. The transparency and automation reduce disputes, giving startups an edge in customer trust.

Startups exploring smart contracts can also leverage platforms like E-contract to integrate blockchain-powered agreements directly into their operations.

Compliance and Global Trust

Compliance is one of the biggest hurdles for startups entering multiple regions. Different countries have varying financial, data, and tax regulations, which can quickly overwhelm small teams. Blockchain simplifies this by creating verifiable audit trails and enabling regulators to access transparent records when needed.

This not only builds trust but also reduces the risk of penalties. Harvard Business Review has highlighted blockchain’s role in making compliance more efficient, particularly for smaller organisations that cannot afford heavy regulatory teams (HBR, 2024). For UK startups, this means global scaling is more achievable than ever before.

The Role of Incubators and Venture Capital

Global scaling often requires strategic guidance and financial support. Effective incubators and venture capital funds are increasingly prioritising blockchain startups because of their potential to disrupt traditional industries. Europe, in particular, has become a hub for blockchain accelerators that provide technical infrastructure, mentorship, and funding opportunities.

For entrepreneurs wondering about the best country for blockchain startup, the UK remains a strong contender due to government-backed initiatives and access to international finance hubs. However, countries like Estonia, Switzerland, and Germany are also attractive for their regulatory frameworks and established blockchain ecosystems.

Venture capitalists are taking notice. Funding for blockchain startups in Europe grew significantly in 2024, with investors targeting fintech, compliance, and infrastructure-focused projects. This trend shows no sign of slowing in 2025.

TheCodeV’s Guidance for Global Ambitions

At TheCodeV, we help startups map their global expansion strategies with blockchain at the core. From exploring funding opportunities to integrating cross-border payment systems, our consultancy ensures UK startups can compete on a worldwide stage. Our expertise bridges both the technical and regulatory requirements of scaling globally, ensuring founders grow confidently and sustainably.

Future Trends – Web3, DAOs, and AI for Startups

The startup landscape in 2025 is evolving faster than ever before. Emerging technologies are no longer operating in isolation—they are converging to create entirely new ecosystems. Among these, blockchain, Web3, and artificial intelligence (AI) are forming the backbone of next-generation businesses. For founders exploring opportunities in this space, understanding how decentralised autonomous organisations (DAOs), AI-driven insights, and blockchain-powered infrastructures combine is crucial.

The Synergy of Blockchain and AI

While blockchain provides transparency and trust, AI delivers predictive insights and automation. Together, they create a powerful framework for startups. For example, AI can analyse decentralised transaction data to detect fraud or optimise financial decisions, while blockchain ensures that every action is traceable and tamper-proof.

Gartner has reported that AI combined with blockchain can help businesses achieve unprecedented levels of efficiency, particularly in compliance, payments, and decision-making (Gartner, 2024). Academic studies also point to the complementarity of these technologies: AI thrives on data, and blockchain provides an immutable, verifiable dataset that enhances the accuracy of machine learning models.

Startups that partner with a blockchain development company for startup initiatives are well-positioned to integrate these dual benefits—building platforms that are not only trustworthy but also intelligent and adaptive.

DAOs: Redefining Governance and Funding

One of the most exciting aspects of Web3 is the rise of decentralised autonomous organisations. DAOs enable communities of investors, customers, or stakeholders to participate in decision-making through transparent voting systems on the blockchain. For startups, this represents a radical shift from top-down governance to participatory, community-driven models.

Funding is also being transformed. Fundraising for blockchain startups is no longer confined to traditional venture capital. DAOs allow global communities to pool resources, supporting innovative projects without relying on intermediaries. Startups can issue governance tokens that grant voting rights, creating a sense of shared ownership and accountability.

Case studies from Europe and Asia show that DAO-driven ventures are successfully raising millions in early-stage funding, often faster and more democratically than through traditional channels.

Adaptive Business Models in Web3

With blockchain and AI forming the foundation, startups are building adaptive business models capable of scaling in real time. For instance, fintech startups can launch blockchain-powered lending platforms where AI assesses creditworthiness instantly, while smart contracts manage repayments automatically.

Retail and e-commerce startups, meanwhile, can embed AI-driven personalisation into tokenised loyalty systems, ensuring customers receive tailored rewards that strengthen long-term engagement. The combination of Web3 infrastructure with AI-powered analytics creates business models that are not only innovative but also resilient against disruption.

Startups can learn more about these innovations by exploring resources like AI in Business UK 2025 and TheCodeV’s expertise in Adaptive Software Development. Both highlight the importance of building flexible, scalable systems that integrate emerging technologies.

Why Startups Must Act Now

The convergence of blockchain, DAOs, and AI is not a distant future—it is happening today. Startups that experiment with these technologies now will gain an edge in fundraising, governance, and customer engagement. Those that delay risk losing ground to competitors who are faster to innovate.

By adopting decentralised systems, leveraging DAOs, and embedding AI into their strategies, UK startups can build businesses that are transparent, intelligent, and community-driven. This combination represents the future of entrepreneurship—one where technology and trust move hand in hand.

Conclusion: Blockchain & Web3 for Startups – Building the Future of Business

The journey of blockchain for startups in 2025 is no longer just about experimentation—it is about transformation. Across finance, trust, marketing, identity, and global expansion, blockchain has proven itself to be the foundation for transparency, efficiency, and resilience. For UK startups, the choice is clear: those who embrace blockchain and Web3 today will set the standards for tomorrow’s business models.

Finance, Trust, and Identity Reimagined

From embedded finance to transparent accounting, blockchain is reshaping how startups manage money. Instead of slow, expensive systems, founders now have access to instant, secure, and verifiable blockchain payment solutions. For investors, this transparency builds confidence, while for customers, it signals credibility.

Trust is further amplified through blockchain-powered identity systems. By simplifying KYC and enabling tamper-proof onboarding, startups protect themselves against fraud while delivering smoother customer experiences. As Deloitte and UK government pilots have shown, blockchain identity management is moving from concept to reality—making it essential for small businesses aiming to scale responsibly.

Databases, Marketing, and Community Building

Data has become the most valuable asset of modern startups. With blockchain databases for startups, founders can operate resilient, decentralised infrastructures that scale globally without being tied to vendor lock-in. This architecture unlocks opportunities for automation, AI integration, and transparent record-keeping that traditional SaaS databases cannot match.

Marketing has also entered a new era. Through tokenised loyalty schemes, NFTs for customer rewards, and transparent influencer payments, blockchain enables startups to build trust-driven communities. Web3 marketing empowers founders to create authentic engagement, turning customers into advocates and communities into brand partners.

New Models, DAOs, and AI Synergy

The rise of decentralised autonomous organisations (DAOs) and the fusion of blockchain with artificial intelligence represent the future of entrepreneurship. DAOs make governance and fundraising more democratic, while AI ensures decisions are faster and smarter. Together, they give startups unprecedented agility in adapting to customer needs and market changes.

For a UK founder, this convergence offers a competitive advantage on a global stage—unlocking access to venture capital, incubators, and borderless markets.

Why UK Startups Must Act Now

The momentum behind blockchain is accelerating. Waiting for competitors to move first risks losing customers, funding, and trust. The UK has already positioned itself as a fintech and Web3 hub, making now the right moment for startups to seize the opportunity. Blockchain is no longer optional—it is the foundation of finance, trust, and growth.

TheCodeV: Your Partner in Blockchain Transformation

At TheCodeV, we have guided startups across industries in adopting blockchain strategies tailored to their growth ambitions. Whether through consultation or hands-on technical deployment, our team ensures founders build secure, scalable, and investor-ready platforms. Our expertise extends across finance, marketing, identity, and infrastructure—bridging the gap between vision and execution.

As a complementary partner, EmporionSoft strengthens this ecosystem by delivering blockchain and AI-driven consultancy for scaling businesses globally. Together, TheCodeV and EmporionSoft provide the technical expertise, strategic insight, and execution power that modern startups need.

Take the Next Step

The future belongs to founders who act boldly. By adopting blockchain today, startups can build businesses that are trusted, transparent, and ready to compete worldwide. Whether you are at the idea stage or preparing for global expansion, TheCodeV is here to help you harness blockchain and Web3 with confidence.